On June 21st, 2018, the US Supreme Court issued a ruling in the South Dakota v Wayfair case. Basically, to sum up this sales tax ruling, the state of South Dakota can now require online stores to collect sales tax from those making purchases within the state of South Dakota.

I just want to give a little background on this ruling before going into how it will impact online businesses. Before the South Dakota v Wayfair case, most states only required online retail stores to collect sales tax on purchases made in the state in which they had a physical presence. However, the state of South Dakota sought to change this. In the South Dakota v Wayfair case, South Dakota wanted to collect sales tax on any goods or services into their state that exceeded the minimum requirement. Bigcommerce stated that “lacking an income tax and heavily reliant on sales tax, South Dakota argued that its inability to tax out-of-state internet retailers cost the state billions of dollars in revenue”.

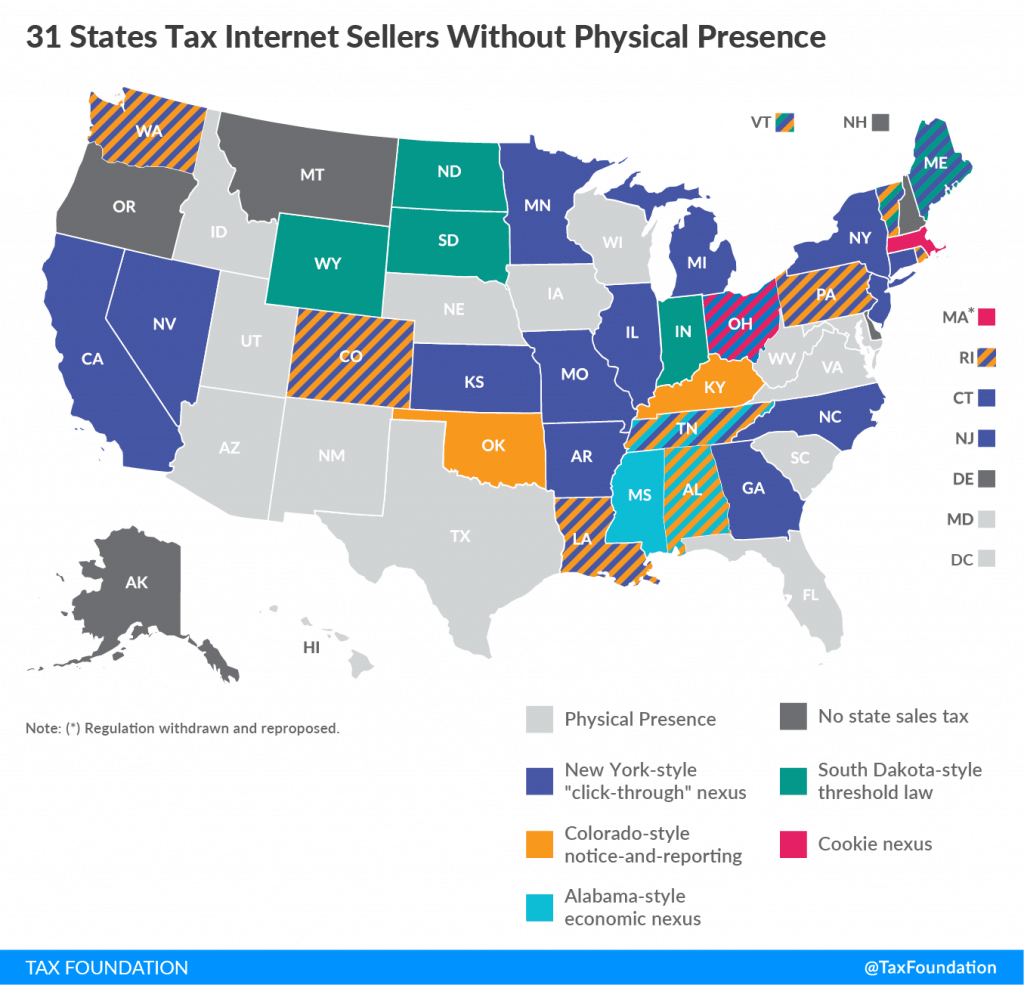

The US Supreme Court ruled in South Dakota’s favor and is now allowing South Dakota to collect sales tax on incoming goods and services to their state. This ruling applies to all online retailers, regardless of where their physical store is located. So, for example, if an online retail store is located in Pennsylvania, but someone from South Dakota orders from their website, that online store must collect sales tax. As of today, the ruling only applies to those out-of-state retailers that deliver goods and services of a value greater than $100,000 into South Dakota or more than 200 transactions per year. However, BigCommerce says that “This precedent establishes a framework for other states to enact or alter laws concerning taxing internet sales”. In fact, 31 states already currently have laws that tax internet sales, but it varies from state to state.

Image Credit: TaxFoundation.org

How will this sales tax ruling impact online retail stores?

Since the threshold for this sales tax ruling is anything under $100,000 or 200 transactions a year, it will likely not affect small businesses. That being said, many are speculating that this has opened up the possibility to many different sales tax changes and reforms in the future, so it could have a more serious impact on small businesses in the years to come. This ruling levels out the playing field between larger online retail stores and physical retail stores. Online retail stores will no longer have the tax advantages over the physical stores because they will be required to collect sales tax as well.

If you have any questions about how the South Dakota v Wayfair ruling might affect your business, don’t hesitate to contact us today.